lake county tax bill fl

ALL LENDERS TITLE COMPANIES WITHOUT THE ORIGINAL TAX BILL MUST INCLUDE 5 FOR A DUPLICATE BILL FEE PER PARCEL. Office of the Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Phone.

Lake County Logos Lake County Fl

Online Property Taxes Information At Your Fingertips.

. Main St North Wing 3rd Floor Tavares FL 32778 Phone. 6686076 email addresses are public. Property Taxes No Mortgage 69941800.

To print a tax bill please enter your ten-digit PIN. Property tax is calculated by multiplying the propertys assessed value by the millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. Enter PIN or address.

Ad Pay Your Taxes Bill Online with doxo. These records can include Lake County property tax assessments and assessment challenges appraisals and income taxes. Recording Office Location Lake County Courthouse CH 550 W.

While taxpayers pay their property taxes to the Lake County Treasurer Lake County government only receives about seven percent of the average tax bill payment. CUSTODIAN OF PUBLIC RECORDS. Renew Vehicle Registration Search and Pay Property Tax Pay Tourist Tax Run a Real Estate report Run a Tangible Property report.

Find Lake County Tax Records. Jordan Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Under FS. EST due to planned system maintenance the online payment process and other services will experience intermittent outages.

Search all services we offer. Office of the Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Phone. In accordance with 2017-21 Laws of Florida 119 Florida Statutes.

All you have to do is sign-up HERE and they will notify you by e-mail when a document is recorded in the official records of Lake County in the name of a monitored owner. The Lake County Clerk of the Court offers a FREE service to help you protect against fraud. Lake County Property Tax Collections Total Lake County Florida.

Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe. Treasurer Tax Collector Offices in Lake County FL are responsible for the financial management of government funds processing and issuing Lake County tax bills and the collection of Lake County personal and real property taxes. The collection begins on November 1st for the current tax year of January through December.

The rates are expressed as millages ie the actual rates multiplied by 1000. You can monitor up to 5 different names per registered e-mail address. On Friday April 8 2022 from 900 pm1000 pm.

In accordance with 2017-21 Laws of Florida 119 Florida Statutes. After reviewing the Tax Summary click on Tax Bill in the right hand column. Tax Estimation Calculator.

Past taxes are not a reliable projection of future taxes. Property Taxes Mortgage 101476100. School districts get the biggest portion about 69 percent.

Select the proper tax year in the drop-down menu and click Tax Bill. In accordance with 2017-21 Laws of Florida 119 Florida Statutes. CUSTODIAN OF PUBLIC RECORDS.

ALL LENDERS TITLE COMPANIES WITHOUT THE ORIGINAL TAX BILL MUST. Lake County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lake County Florida. Duplicate tax bills for homeowners available at no charge.

The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021. These real estate taxes are collected on an annual basis by the Lake County Tax Collectors Office. Jordan Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Under FS.

To Print a Tax Bill. Property Taxes Mortgage 101476100. IT IS THE RESPONSIBILITY OF EACH PROPERTY OWNER TO SEE THAT THEIR TAXES ARE PAID AND THAT THEY DO INDEED RECEIVE A TAX BILL.

Enter a name or address or account number etc. Enter a name or address or account number etc. 6686076 email addresses are public.

Or call the Lake County Treasurers Office at 847-377-2323. 6686076 email addresses are public. 4 by November 30th 3 by December 31st 2 by January 31st 1 by February 29th Gross amount by March 31st Taxes become delinquent on April 1st of each year at which time additional penalties collection fees and all other costs apply.

Office of the Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Phone. This tax estimation tool is provided to assist any potential home or business owner with an estimate of the ad valorem property taxes on a new purchase for properties within the municipalities and unincorporated areas of Lake County Florida. Property Taxes No Mortgage 69941800.

Make sure the tax year is set to the right year. Lake County Property Tax Collections Total Lake County Florida. Treasurers Tax Collectors are key departments in the broader Lake County government.

Jordan Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Under FS. For example 2019 taxes are payable and billed in 2020. The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts.

Ad Find Lake County Records Info For Any Address. Disable your popup blocker and click Go. CUSTODIAN OF PUBLIC RECORDS.

Lake County Arrest Court And Public Records

Animal Shelter Adoptions Lake County Fl

Board Of County Commissioners Lake County Fl

Property Tax Search Taxsys Lake County Tax Collector

Property Taxes Lake County Tax Collector

Motor Vehicles Lake County Tax Collector

Property Taxes Lake County Tax Collector

What Is Florida County Real Estate Tax Property Tax

Florida Property Tax H R Block

Florida Dept Of Revenue Property Tax Data Portal

What Is Florida County Tangible Personal Property Tax

Lake County Logos Lake County Fl

Lake County Logos Lake County Fl

Understanding Your Tax Bill Seminole County Tax Collector

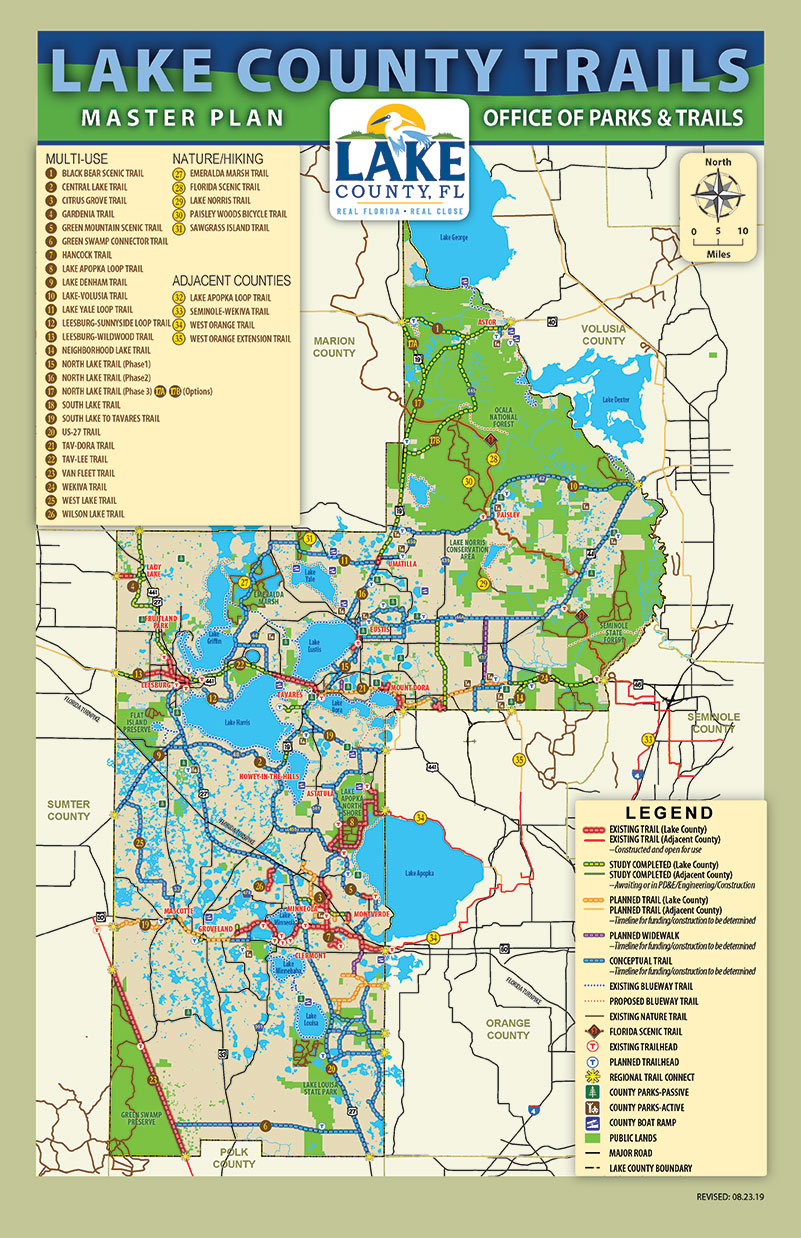

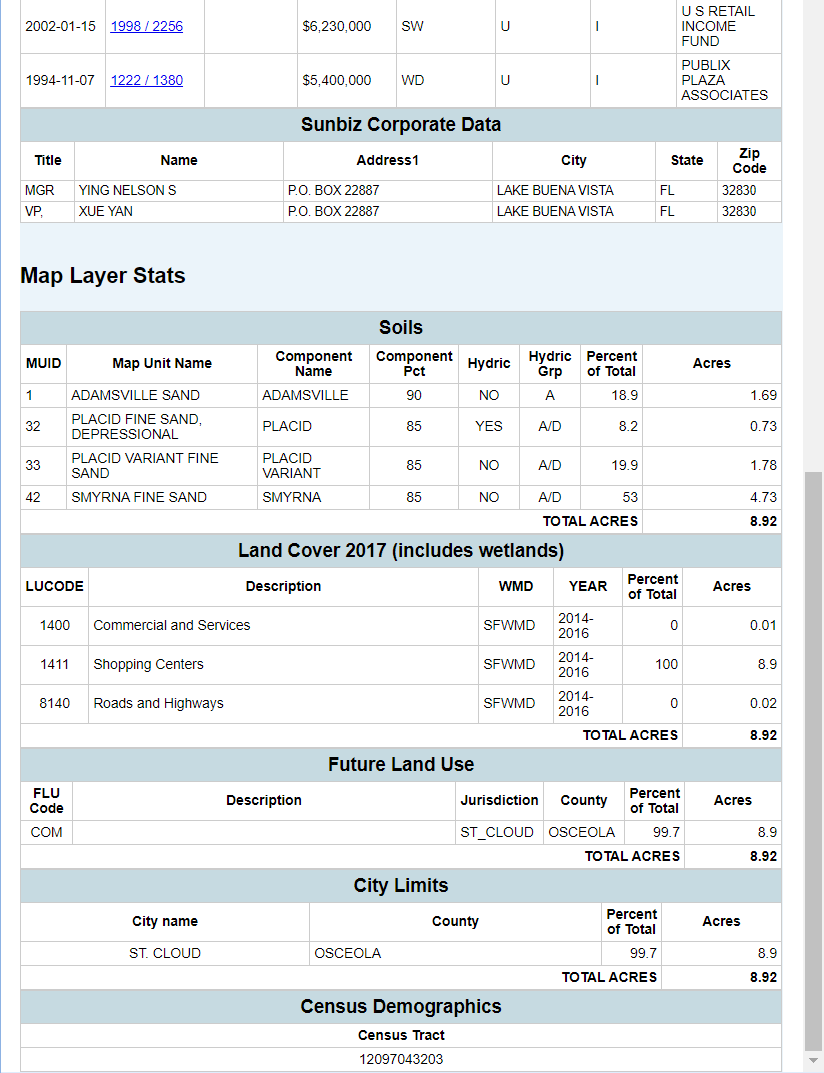

Florida County Property Appraiser Search Parcel Maps And Data